how to file mortgage on taxes

Therefore if one of you paid alone from your own account that. If you need wage and income information to help prepare a past due return.

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

TurboTax is the easy way to prepare your personal income taxes online.

. Now for those new to the mortgage credit certificate program its essential. For tax years before 2018 the interest paid on up to 1 million of acquisition. TurboTax online makes filing taxes easy.

If you own the home together--both names on the mortgage and deed then you can choose to split the amount you. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. Under new changes to tax law because of the TCJA the mortgage interest deduction will only apply to loans of up to 75000000 for married taxpayers filing a joint.

You should receive Form 1098 the Mortgage Interest Statement from your mortgage lender after the close of the tax year typically in January. Your loan servicer should also provide this tax. If you paid mortgage points and youve determined that you qualify for a tax break deducting them is pretty straightforward.

Use Form 1098 Info Copy Only to report mortgage. As you begin to type a property location addresses will appear below. These expenses may include mortgage.

The co-owner is a spouse who is on the same return. This form can be mailed or brought into the Auditors. The first thing you need to know is that interest paid on mortgages is usually deductible from your income provided you itemize deductions rather than choosing standard.

Try it for FREE and pay only when you file. E-file online with direct deposit to. There are different situations that affect how you deduct mortgage interest when co-owning a home.

MORTGAGE TAX is 15 per 10000 or 150 per 100000 of amount financed. The IRS places several limits on the amount of interest that you can deduct each year. How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes Over 50 Milllion Tax Returns Filed.

Mortgage must be recorded before filing for exemption. Please note that the property address entry field will auto populate. They can help you file.

Here is a link to the IN State website to view the Mortgage Deduction form. After completing the mortgage credit certificate tax form Form 8396 its time to submit your taxes. Enter your mortgage interest costs on lines 8 through 8c of Schedule A then transfer the total.

Help Filing Your Past Due Return. This form reports the total. Input the amount of home mortgage interest.

If you have unfiled returns unpaid taxes or a tax lien you should contact a tax pro to help you. Mortgage tax is to be rounded UP to the next highest 10000 on a fraction thereof. You can itemize or you can claim the standard deduction but you cant do both.

Get Help Applying for a Mortgage When You Have Unfiled Returns. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return. Use Form 1098 to report mortgage interest of 600 or more received by you from an individual including a sole proprietor.

When claiming married filing separately mortgage interest would be claimed by the person who made the payment. You cannot file a joint return unlessuntil you are married. How to Deduct Mortgage Points on Your Taxes.

Enter the full amount. Your mortgage lender should send you an IRS 1098 tax form which reports the amount of interest you paid during the tax year.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Rental Property Tax Deductions A Comprehensive Guide Credible

Save Money By Filing For Your Homestead And Mortgage Exemptions

Coming Home To Tax Benefits Windermere Real Estate

What Do Mortgage Lenders Look For On Your Tax Returns Better Mortgage

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

How To Deduct Mortgage Insurance After Refinancing

:max_bytes(150000):strip_icc()/ScreenShot2021-10-01at12.36.46PM-516841a2dc40455cbb7f24f872435284.png)

What Is Form 1098 Mortgage Interest Statement

Home Related Tax Breaks Delaware Business Times

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tax Time Already 2022 Tax Deductions For Homeowners A Covid Rebate

Mortgage Interest Deduction Bankrate

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

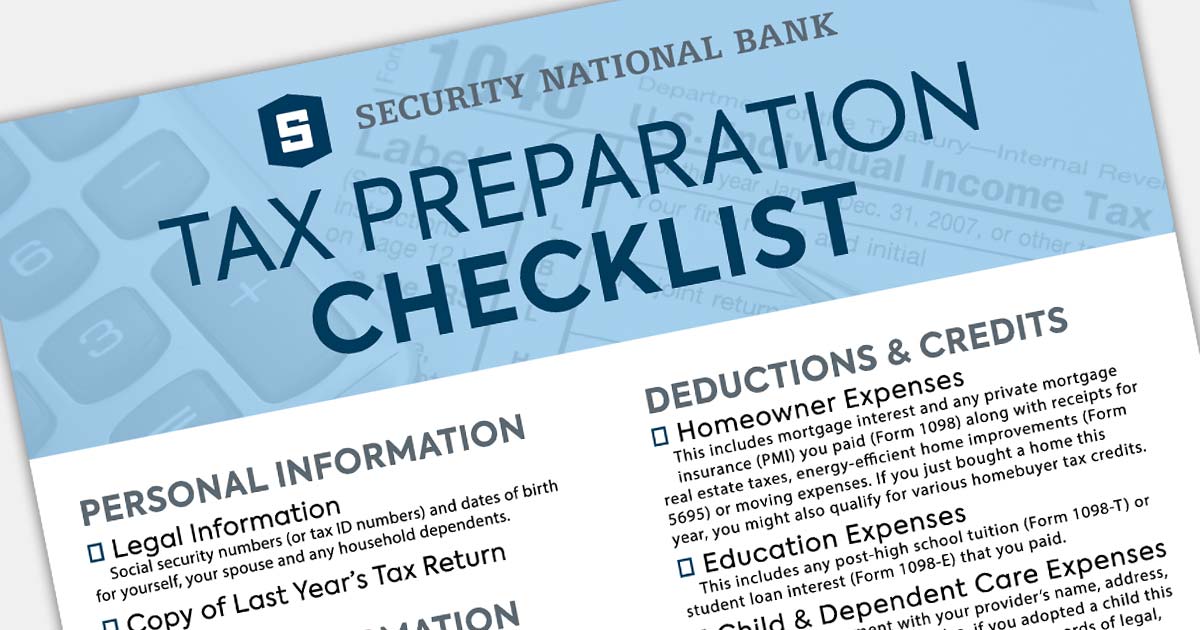

A Checklist What Documents You Need To Prepare Your Taxes